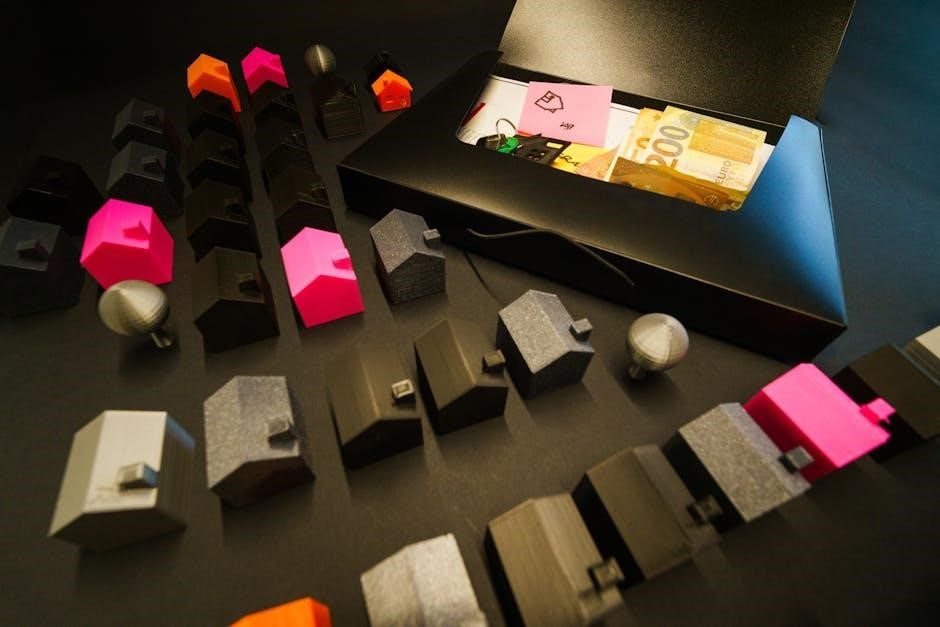

A subject-to existing mortgage contract allows buyers to take over a property’s existing loan, benefiting sellers by avoiding sales complexities. This method enables quick transactions and can prevent foreclosure, offering a cost-effective alternative to refinancing.

1.1 Definition and Overview

A subject-to existing mortgage contract involves a buyer taking over the seller’s existing mortgage, with the loan remaining in the seller’s name. This is often referred to as a “sub-2” deal. The buyer typically provides a cash down payment, usually equivalent to 20% of the property’s value, and assumes responsibility for monthly payments. This arrangement benefits sellers by avoiding the complexities of selling the property outright, while buyers gain a cost-effective alternative to refinancing. The process requires careful review of the mortgage terms and conditions to ensure mutual agreement. It’s a popular strategy for investors seeking efficient transactions and avoiding foreclosure scenarios.

1.2 Importance of Understanding the Process

Understanding the subject-to mortgage process is crucial for both buyers and sellers to navigate the transaction smoothly. It involves assuming an existing loan, which requires reviewing the mortgage terms, interest rates, and repayment schedules. Buyers must ensure the loan has favorable conditions, while sellers need to understand their ongoing liability. Missteps can lead to legal or financial issues, such as foreclosure or breach of contract. Proper due diligence and legal advice are essential to avoid pitfalls. This approach benefits investors seeking efficient transactions but demands a clear grasp of the process to protect all parties involved and ensure a successful outcome.

1.3 Key Benefits for Buyers and Sellers

The subject-to mortgage contract offers significant advantages for both buyers and sellers. For buyers, it eliminates the need for loan qualification, reducing closing costs and time. Sellers benefit by avoiding the complexities of traditional sales, such as marketing and contingencies. This method allows sellers to transfer ownership quickly while potentially avoiding foreclosure. Buyers can negotiate favorable terms, including down payments, directly with sellers. The existing mortgage’s terms, such as lower interest rates, remain intact, making it a cost-effective solution for both parties. This approach streamlines the transaction process, ensuring a smoother and more efficient transfer of property ownership.

What is a “Subject To” Mortgage Contract?

A “Subject To” Mortgage Contract allows buyers to acquire a property by taking over the seller’s existing mortgage, avoiding the need for new loan qualification and closing costs.

2.1 Explanation of the Term “Subject To”

The term “Subject To” refers to a real estate transaction where a buyer assumes ownership of a property while taking over the seller’s existing mortgage. This means the buyer does not obtain a new loan but instead inherits the current mortgage terms, including the interest rate, payment schedule, and remaining balance. The mortgage remains in the seller’s name, but the buyer is responsible for making payments. This arrangement bypasses the need for mortgage qualification and closing costs, making it an attractive option for both buyers and sellers in certain situations. It is commonly used in distressed sales or investor transactions.

2.2 How It Differs from Assuming a Mortgage

A “Subject To” agreement differs from assuming a mortgage in that the buyer does not legally take over the mortgage obligation. Instead, they agree to make payments on the existing loan, while the seller remains legally responsible. In contrast, assuming a mortgage involves obtaining lender approval and transferring the debt to the buyer. “Subject To” bypasses this formal process, offering a faster and less regulated transaction. However, the lender can still hold the seller accountable for default, and the buyer risks foreclosure if payments are missed. This distinction makes “Subject To” a riskier but more flexible option for both parties involved.

2.3 Legal and Financial Implications

Entering into a “Subject To” mortgage contract carries significant legal and financial implications. Legally, the seller remains obligated on the mortgage, even after transferring ownership. This means lenders can pursue the seller for defaults or deficiencies. Financially, buyers assume payment responsibility but do not own the debt, which can lead to complications if payments are missed. Both parties must carefully review the contract to understand liabilities, as hidden clauses may impose additional risks. Legal counsel is often advised to navigate these complexities and ensure compliance with local real estate laws. Missteps can result in financial loss or legal disputes for either side.

Benefits of a Subject to Mortgage Contract

A “Subject To” mortgage contract offers significant benefits, including avoiding costly refinancing and maintaining favorable loan terms. Buyers save on origination fees and closing costs, while sellers expedite the sale process. This method often facilitates smoother, faster transactions, making properties more attractive to potential buyers in competitive markets.

3.1 Advantages for Home Buyers

Home buyers benefit significantly from “Subject To” contracts by avoiding the need to qualify for a new mortgage, which can be time-consuming and costly. This approach allows buyers to retain the existing loan’s favorable terms, such as lower interest rates or lower monthly payments. Additionally, buyers save on origination fees, appraisal costs, and other expenses associated with securing a new loan. The process also enables faster closings, as it bypasses traditional mortgage underwriting. This makes it an attractive option for buyers seeking to acquire a property quickly while maintaining financial flexibility and stability.

3.2 Advantages for Home Sellers

Home sellers benefit from “Subject To” contracts by avoiding costs and delays associated with settling the existing mortgage. This arrangement allows sellers to transfer mortgage responsibilities to buyers, potentially accelerating the sale process. It also attracts buyers interested in assuming favorable loan terms, increasing the property’s appeal. Sellers facing financial difficulties may avoid foreclosure, protecting their credit standing. Overall, “Subject To” contracts offer sellers a swift and financially advantageous way to transfer property ownership while mitigating potential losses effectively.

3.3 How It Facilitates Quick Transactions

A “Subject To” mortgage contract streamlines the home-buying process by eliminating the need for buyers to secure new financing. This bypasses lengthy loan approvals, credit checks, and appraisals, allowing transactions to close faster. Sellers benefit from a quicker sale, while buyers avoid delays and additional costs. The existing mortgage terms remain in place, reducing paperwork and accelerating the transfer of ownership. This arrangement is particularly advantageous in competitive markets or when a rapid closing is essential. It ensures a smoother, more efficient transaction for all parties involved, making it an attractive option for those seeking a swift and hassle-free process.

The Process of Taking Over an Existing Mortgage

Taking over an existing mortgage involves evaluating the loan terms, performing due diligence, negotiating with the seller, preparing legal documents, and closing the deal smoothly.

4.1 Steps to Assume an Existing Mortgage

Assuming an existing mortgage involves several key steps. First, the buyer reviews the mortgage terms to ensure they are acceptable. Next, they must obtain lender approval, as most loans require the lender’s consent for a transfer. The buyer and seller then draft a “Subject To” agreement, outlining the takeover terms. Due diligence, including a title search, is essential to verify the property’s legal status. The parties proceed to closing, where the agreement is finalized. Post-closing, the buyer assumes responsibility for payments and maintains communication with the lender to ensure smooth transitions. Proper documentation and legal oversight are crucial throughout the process.

4.2 Due Diligence for Buyers

Due diligence is critical for buyers assuming an existing mortgage. Start by reviewing the mortgage terms, including interest rates, remaining balance, and payment history. Conduct a title search to ensure the property is free of liens or legal disputes. Evaluate the property’s condition through inspections to avoid hidden repair costs. Assess the market value to confirm it aligns with the purchase price. Review the seller’s payment history to ensure the mortgage is in good standing. Finally, consult with legal and financial professionals to verify the agreement’s terms and protect your interests. Thorough due diligence safeguards against potential risks and ensures a smooth transaction.

4.3 Negotiating Terms with the Seller

Negotiating terms with the seller is a crucial step in a subject-to mortgage transaction. Buyers should clarify responsibilities, such as who will make payments until closing. Discuss the seller’s expectations regarding the sale price, closing timeline, and any credits or concessions. Ensure agreement on property maintenance and repairs. Verify if the seller will provide clear title or if liens exist. Consider including a contingency for the seller to address any mortgage-related issues. A well-negotiated agreement protects both parties and ensures a smooth transition. Written terms prevent misunderstandings and align expectations, fostering a mutually beneficial outcome for all involved in the transaction.

4.4 preparing the Subject to Agreement

4.4 Preparing the Subject to Agreement

Preparing the subject-to agreement requires careful attention to detail to ensure all terms are clear and legally binding. The agreement should include the existing mortgage details, such as the outstanding balance, interest rate, and payment terms. It should also outline the transfer of property title and responsibility for future payments. The document must specify the effective date of the agreement and include signatures from both the buyer and seller. Clarity is crucial to avoid disputes. Legal and real estate professionals should review the agreement to ensure compliance with local laws. Additional terms, such as property maintenance or repair obligations, should also be included.

A title search and insurance are often required to protect both parties. This step ensures a smooth transition and safeguards everyone involved in the transaction.

4.5 Closing the Deal

Closing the deal in a subject-to agreement involves finalizing all legal and financial aspects. Both parties sign the agreement, transferring property ownership while the buyer assumes the existing mortgage. A title search ensures no liens exist, and title insurance protects against future claims. Legal professionals review documents to ensure compliance. The deed is transferred, and keys are handed over. Payment arrangements are confirmed, with the buyer taking over mortgage payments. This step ensures a smooth transition, protecting both buyer and seller from potential issues. Final checks by legal experts ensure everything is in order, completing the process efficiently and securely.

4.6 Post-Closing Responsibilities

After closing, the buyer assumes full responsibility for the property and mortgage payments. They must ensure timely payments to avoid late fees or penalties. The buyer should also maintain property maintenance and handle any outstanding taxes or liens. Communication with the seller may still be necessary to address any post-closing issues. Updating records with the lender and local authorities is essential to reflect ownership changes. Monitoring the mortgage terms and conditions ensures compliance with the existing agreement. These steps safeguard the buyer’s investment and maintain a smooth relationship with all parties involved, ensuring long-term financial stability and legal clarity.

Legal and Financial Implications

Understanding the legal and financial implications of a subject to contract is crucial. Buyers must adhere to the existing mortgage terms, including interest rates and payment schedules. Failure to comply can lead to legal consequences or financial penalties. It’s essential to review all clauses and seek legal advice to avoid unforeseen liabilities. Financially, buyers must ensure they can manage the mortgage payments and any associated costs, such as property taxes or insurance. Proper planning and due diligence are vital to navigate these complexities successfully and protect all parties involved in the transaction.

5.1 Understanding the Existing Mortgage Terms

Understanding the existing mortgage terms is critical when entering a subject to contract. Buyers must review the original loan agreement to identify key components such as interest rates, payment schedules, loan balance, and remaining terms. Familiarizing oneself with these details ensures compliance and avoids unexpected financial burdens. Overlooking specific clauses or conditions can lead to legal or monetary consequences. It’s also important to verify the lender’s policies regarding subject to contracts, as some may impose restrictions or require additional approvals. Buyers should seek professional advice to interpret complex terms and ensure they fully grasp their obligations before proceeding.

5.2 Reviewing the Contract for Hidden Clauses

Reviewing the contract for hidden clauses is essential to avoid unforeseen obligations. Buyers should carefully examine the agreement for terms like prepayment penalties, acceleration clauses, or due-on-sale clauses, which can significantly impact their financial situation. These clauses may not be immediately apparent, so a meticulous review is crucial. Legal professionals or real estate experts can assist in identifying and interpreting such provisions. Missing these details could lead to financial penalties or legal challenges. Ensuring transparency and understanding all terms prevents future disputes and safeguards both parties’ interests in the subject to transaction.

5.3 Importance of Title Search and Insurance

A title search is critical to ensure the property’s legal status is clear and free from hidden liens or disputes. It verifies the seller’s ownership and identifies any potential issues that could affect the transfer. Title insurance further protects both buyers and lenders from future claims or undiscovered defects in the title. This step is especially vital in subject to transactions, as the buyer assumes the existing mortgage. A thorough title search and insurance provide peace of mind and safeguard against unforeseen legal or financial risks, ensuring a smooth and secure transfer of property ownership.

5.4 Financial Responsibilities Post-Takeover

After taking over a subject to mortgage, the buyer assumes all financial responsibilities tied to the property. This includes making timely mortgage payments, paying property taxes, and securing insurance. The buyer must also cover maintenance and repair costs. Failure to meet these obligations can lead to late fees, penalties, or even foreclosure. Additionally, the buyer may be liable for any unpaid liens or debts attached to the property. It’s crucial to review the contract for any clauses that outline shared financial responsibilities with the seller. Understanding these duties ensures the buyer can manage the property’s finances effectively and avoid potential pitfalls.

Risks and Challenges of Subject to Contracts

Subject to contracts carry risks like hidden clauses, payment defaults, and potential liens. Buyers may face financial losses if the seller’s mortgage has unfavorable terms. Proper due diligence and professional guidance are essential to mitigate these challenges and ensure a smooth transaction.

6.1 Potential Risks for Buyers

Buyers in subject to contracts face risks such as inheriting unfavorable mortgage terms, hidden clauses, or existing liens on the property. If the seller’s mortgage has high interest rates or balloon payments, the buyer may struggle financially. Additionally, if the seller’s credit history is poor, it could impact the property’s title or lead to foreclosure. Buyers must also ensure the seller is current on payments, as missed payments could result in legal action. Without proper due diligence, buyers may assume unexpected liabilities, making it crucial to review the mortgage terms and seek legal advice to avoid potential financial or legal pitfalls.

6.2 Risks for Sellers in Subject to Deals

Sellers in subject to deals face risks, including remaining legally responsible for the mortgage if the buyer defaults. This can damage the seller’s credit and lead to foreclosure proceedings. Sellers may also lose the opportunity to receive full payment for the property, as buyers often negotiate lower prices. If the buyer fails to maintain property upkeep, it could reduce the property’s value or lead to legal disputes. Additionally, sellers may face tax implications or legal consequences if the deal is not properly structured. To mitigate these risks, sellers must ensure the buyer is financially stable and seek legal oversight to protect their interests.

6.3 How to Mitigate Risks

To mitigate risks in subject to deals, both buyers and sellers must conduct thorough due diligence. Buyers should verify the property’s value, review the mortgage terms, and ensure the seller is cooperative. Sellers should vet buyers’ financial stability and ensure the transfer process is legally sound. Legal counsel is crucial to draft and review agreements, protecting both parties. Clear communication and written agreements can prevent disputes. Buyers should also maintain timely mortgage payments and properly maintain the property. By taking these steps, the risks associated with subject to deals can be significantly reduced, creating a safer transaction for all involved.

Case Studies and Real-Life Examples

A buyer successfully took over a mortgage, avoiding foreclosure for the seller. The process involved due diligence, negotiation, and a clear agreement, showcasing mutual benefits.

7.1 Successful Subject to Transactions

A common example of a successful “subject to” transaction involves a seller facing foreclosure. The buyer assumes the existing mortgage, preventing foreclosure and allowing the seller to avoid financial ruin. The buyer benefits by acquiring the property with favorable loan terms. Proper due diligence ensures the buyer understands the mortgage obligations, while clear communication with the seller fosters trust. Legal documentation, including a “subject to” agreement, protects both parties. Such transactions highlight the win-win potential of this strategy, offering a quicker and cost-effective alternative to traditional methods. These success stories demonstrate how “subject to” deals can align buyer and seller interests effectively.

7.2 Lessons Learned from Failed Deals

Failed “subject to” deals often stem from inadequate due diligence or poor communication. Buyers may overlook unfavorable mortgage terms or existing liens, leading to financial burdens. Misunderstandings about the seller’s financial standing can also derail agreements. In some cases, lenders may not honor the “subject to” clause, causing unexpected complications. To avoid such pitfalls, buyers must thoroughly review the mortgage contract and ensure the seller is current on payments. Clear agreements and legal oversight are essential to prevent disputes. Learning from these failures emphasizes the importance of transparency, proper documentation, and involving legal experts to safeguard both parties’ interests in the transaction.

7.3 How Real Investors Use Subject to Contracts

Real estate investors often utilize “subject to” contracts to acquire properties efficiently without securing new financing. This strategy allows them to take over existing mortgages, reducing upfront costs and accelerating the acquisition process. Investors typically target distressed sellers or those facing foreclosure, offering a quick solution. By assuming the mortgage, investors can leverage the property’s equity while avoiding traditional lending hurdles. They often negotiate favorable terms, ensuring the deal aligns with their financial goals. Successful investors also conduct thorough due diligence, reviewing mortgage terms and property conditions to mitigate risks. This approach enables them to build portfolios quickly and capitalize on market opportunities.

Avoiding Foreclosure Through Subject to Contracts

Subject to contracts help distressed homeowners avoid foreclosure by transferring ownership while keeping the existing mortgage intact, allowing sellers to exit gracefully and buyers to step in.

8.1 How Subject to Can Prevent Foreclosure

A “subject to” contract allows the transfer of property ownership while keeping the existing mortgage in place, preventing foreclosure. This process stops foreclosure proceedings by ensuring mortgage payments continue. The buyer assumes responsibility for the loan, relieving the seller of debt obligations. This solution is particularly beneficial for distressed homeowners facing financial hardship, as it avoids the negative credit impact of foreclosure. The lender typically remains unaware of the ownership change, and the original mortgage terms remain intact. This approach provides a swift resolution, protecting the seller’s credit and allowing the buyer to acquire the property without securing new financing.

8.2 Benefits for Distressed Homeowners

Subject to contracts offer significant relief for distressed homeowners facing foreclosure. By transferring ownership, homeowners avoid the long-term credit damage associated with foreclosure. This option allows them to exit the property gracefully while maintaining some control over the process. The buyer assumes mortgage payments, halting foreclosure proceedings and providing immediate financial relief. Distressed homeowners also avoid the emotional strain of losing their home, as they can negotiate terms that align with their needs. Additionally, this method prevents the negative impact on their credit score, helping them recover financially in the long term. It’s a viable solution for those overwhelmed by debt.

8.3 Role of Investors in Foreclosure Prevention

Investors play a pivotal role in foreclosure prevention by offering alternatives to traditional sales. They specialize in subject to contracts, enabling distressed homeowners to transfer ownership without the lender’s approval. By assuming the existing mortgage, investors halt foreclosure proceedings, protecting the homeowner’s credit. Investors negotiate terms directly with sellers, providing quick solutions to financial crises. They also handle due diligence and legal processes, ensuring smooth transitions. This approach allows homeowners to avoid foreclosure stigma while investors acquire properties at favorable terms. Investors’ involvement creates a win-win scenario, preserving the homeowner’s credit and offering a viable exit strategy.

Subject to Contracts and Real Estate Investors

Real estate investors favor subject to contracts for their efficiency and cost-effectiveness, enabling quick property acquisitions while avoiding traditional financing hurdles, fostering portfolio growth and market opportunities.

9.1 Why Investors Prefer Subject to Deals

Real estate investors favor subject to contracts due to their efficiency and cost-effectiveness. These deals allow investors to acquire properties quickly by taking over existing mortgages, bypassing the need for new financing. This saves time and reduces costs associated with loan applications and appraisals. Additionally, subject to deals enable investors to leverage the existing mortgage terms, which may offer more favorable interest rates or lower monthly payments. This approach also preserves the seller’s equity, making it attractive for distressed sellers. Overall, subject to contracts provide investors with a strategic advantage in competitive markets, enabling them to expand their portfolios rapidly and profitably.

9.2 How Investors Can Benefit Financially

Investors can achieve significant financial gains through subject to deals by minimizing upfront costs and maximizing cash flow. By assuming existing mortgages, they avoid expensive loan origination fees and high down payments. This reduces initial capital outlay, freeing up funds for other investments. Additionally, subject to deals allow investors to capitalize on favorable loan terms from the seller’s mortgage, such as lower interest rates or longer repayment periods. Rapid acquisition enables investors to quickly build their portfolios and generate rental income sooner; Overall, these deals provide a cost-effective strategy for investors to enhance profitability and achieve long-term financial growth in real estate.

9.3 Strategies for Investors to Succeed

To succeed in subject to deals, investors must employ strategic approaches. Conducting thorough due diligence on the property and existing mortgage is crucial to identify potential risks. Building a strong network of real estate agents, attorneys, and lenders specializing in subject to transactions is essential. Negotiating favorable terms with sellers, such as repayment plans or reduced payments, can enhance profitability. Managing risks through proper documentation and legal review ensures compliance. Additionally, maintaining clear communication with sellers and prioritizing their needs builds trust. By combining these strategies, investors can minimize challenges, maximize returns, and achieve sustainable success in subject to real estate investing.

Resources and Tools for Understanding Subject to Contracts

- eBooks and guides on subject to contracts.

- Online webinars and video tutorials.

- Legal templates for drafting agreements.

- Mortgage calculators for financial planning.

- Real estate forums for expert advice.

- Professional networks for investor support.

10.1 Recommended Books and Guides

Several books and guides provide in-depth insights into subject to contracts, offering practical strategies and legal frameworks. Titles like “Subject To: The Risks and Rewards” and “Mastering Subject To Real Estate Deals” are highly recommended. These resources cover negotiation techniques, contract drafting, and risk mitigation. Additionally, “The Subject To Mortgage Handbook” is a comprehensive guide for understanding the intricacies of assuming existing mortgages. Many of these guides are available as downloadable PDFs, making them accessible for quick reference. They often include real-life case studies and expert advice, ensuring readers gain a thorough understanding of the subject to process.

10.2 Online Courses and Tutorials

Online courses and tutorials provide hands-on training for mastering subject to contracts. Platforms like Udemy, Coursera, and Real Estate Express offer courses tailored for investors and homebuyers. These programs cover topics such as contract negotiation, legal compliance, and risk management. Many courses include video lessons, downloadable templates, and interactive exercises to enhance learning. Specialized tutorials, such as “Subject To Real Estate Investing” and “Mastering Mortgage Takeovers,” are designed to equip learners with practical skills. These resources are ideal for those seeking a structured approach to understanding subject to contracts and their application in real estate transactions.

10.3 Legal Templates and Forms

Legal templates and forms are essential for drafting and executing subject to contracts. Websites like LegalZoom and Rocket Lawyer offer customizable templates tailored to real estate transactions. These include subject to agreements, purchase contracts, and addenda. Forms are designed to ensure compliance with local laws and protect all parties involved. They often cover key elements like property details, payment terms, and responsibilities post-transfer. Using these templates can save time and reduce legal risks. Many platforms provide user-friendly interfaces to input specific information, making the process efficient. Always consult a legal expert to review and customize the documents for your specific situation.